History of financial company Exness

The history of Exness began in 2008, when its founders, Igor and Vladimir Lavrenov, first launched a trading server. Since then, Exness has become one of the leading brokers in the online trading market.

In its early years, Exness focused on developing its technological infrastructure and creating a robust Forex trading platform. The company sought to provide its clients with fast execution of transactions, low spreads and access to a wide range of trading instruments.

In subsequent years, Exness actively expanded its client base, attracting traders from all over the world thanks to its reliability, innovative technologies and competitive trading conditions. The company has also received a number of prestigious awards and certifications in the online retail industry.

Today, Exness continues to develop and expand its presence in global financial markets. It offers its clients a wide range of trading services and products, and constantly introduces new technologies and tools to provide the best trading experience.

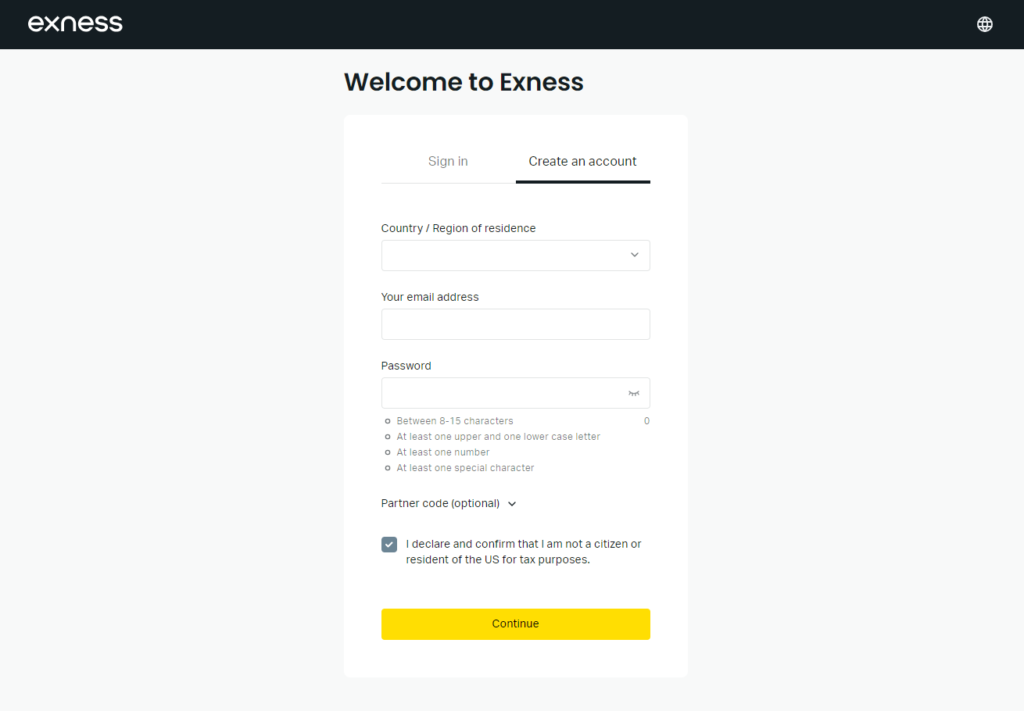

Registration in Exness

To register with Exness you need to complete the following steps:

- Go to the Exness official website.

- Click on the “Registration” or “Open Account” button, which is usually located in the upper right corner of the site.

- Fill out the registration form with your personal information such as name, email address and phone number. Be sure to provide correct details as they will be used to verify your identity for subsequent withdrawals.

- Choose a trading account type that suits your trading needs and experience.

- Confirm your registration by following the onscreen instructions. This usually involves confirming your email address and completing an identity verification process by providing the required documents.

- Once registration is complete, you will be given access to your trading account, where you can fund your account and start trading Forex and other markets.

Remember that trading the financial markets involves the risk of losing money, so it is important to be careful and informed when making trading decisions. In addition, before starting trading, it is recommended that you read the terms and conditions of the Exness broker.

Exness Personal Account

The Exness Personal Account is an online platform through which clients can manage their trading accounts, carry out trading operations, deposit and withdraw funds, and access various information and tools. Here are the main functions and features available in your Exness personal account:

- Account Management: Clients can see the status of their trading accounts, including balances, available funds, open positions, etc. They can also manage their accounts, change settings and set trading options.

- Trading: The Personal Account provides access to trading platforms such as MetaTrader 4 and MetaTrader 5, where clients can trade Forex and other markets, as well as perform market analysis and use trading tools.

- Deposits and Withdrawals: Clients can make deposits into their trading accounts and withdraw funds from their accounts through various payment systems and methods provided by Exness.

- Reports and Analytics: Various trading reports, statistics and analytical tools are available in the personal account to help clients monitor their market activity and make informed decisions.

- Support: Clients can contact support through their personal account for assistance with questions and issues related to trading or using the platform.

These are the main functions that are available in your Exness personal account. The company constantly updates and improves its services, so the capabilities of your personal account may change depending on current conditions and customer needs.

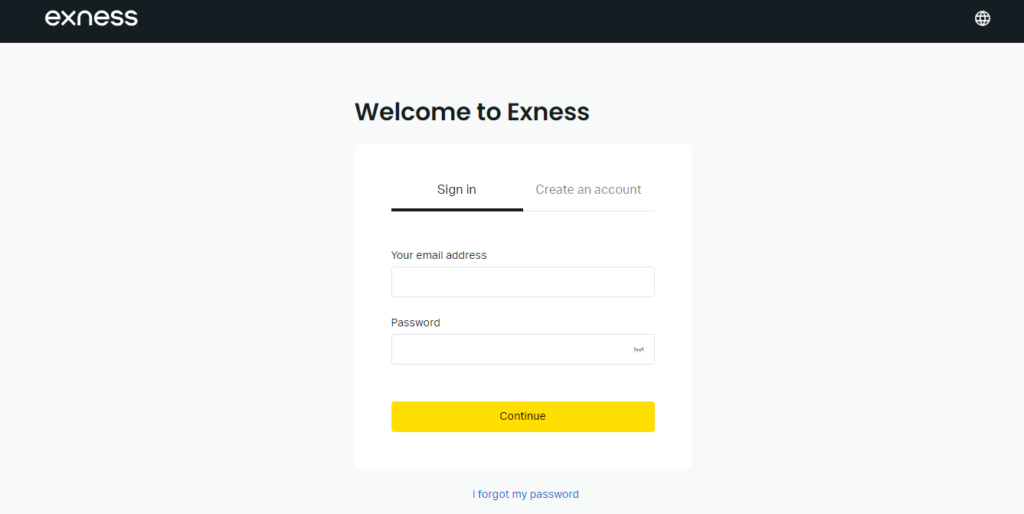

Exness Login

For Exness login, you should follow these steps:

- Go to the official Exness website: Open your web browser and enter the address of the official Exness website.

- Log in to your personal account: On the main page of the site, find the “Personal Account” or “Login” section. Typically, this place is located in the upper right corner of the page. Click on the appropriate link.

- Enter your credentials: Enter your username (account number) and password that you used when registering with Exness.

- Click “Login” or “Login”: After entering your credentials, click the appropriate button to log into your personal account.

After successfully Exness logging in, you will find yourself in your Exness personal account, where you can manage your account, carry out financial transactions, open and close trades, and access various trading tools and resources.

If you have any difficulties accessing your personal account or with Exness login, it is recommended to contact Exness support, which usually provides assistance with various questions and problems.

Exness Trading Tools

Exness provides its clients with access to a wide range of instruments for trading on international financial markets. Here are some of the main instruments that are available for trading on Exness platforms:

- Currency Pairs (Forex): Clients can trade the Forex market with a wide range of currency pairs, including major (eg EUR/USD, GBP/USD), cross currency pairs and exotic currency pairs.

- Metals: Exness offers trading in metals such as gold and silver. Metals trading is a popular way for investors to protect their portfolios during periods of market volatility.

- Energy: Clients can trade oil and natural gas, allowing them to profit from fluctuating energy prices.

- Shares: Exness provides the opportunity to trade shares of the world’s largest companies, such as Apple, Google, Microsoft and others.

- Indices: Clients can trade indices of various countries and regions, such as S&P 500, FTSE 100, DAX 30 and others.

- Cryptocurrencies: Exness provides the ability to trade a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin and others.

These are just some of the main instruments available for trading on Exness platforms. Clients can choose from a variety of assets depending on their preferences, strategies and investment goals.

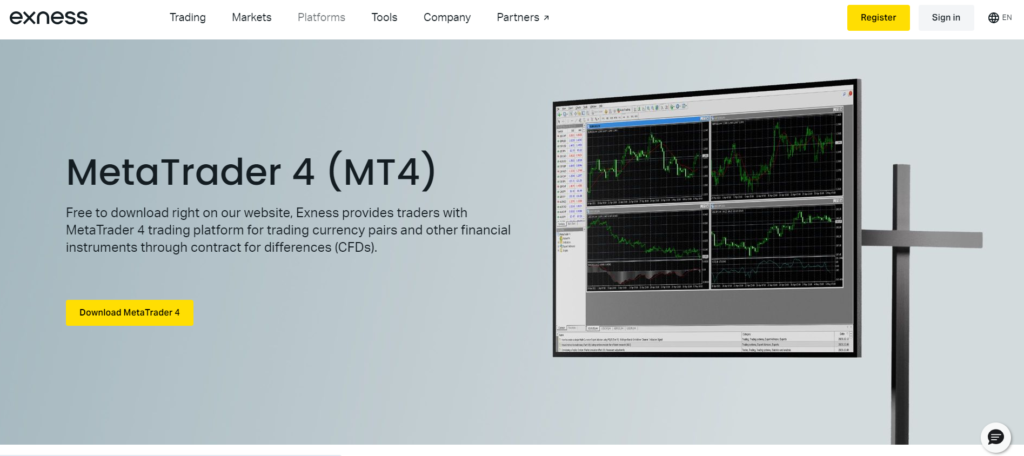

Exness MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader is a popular trading platform provided by many brokers, including Exness. MetaTrader is one of the most widespread and functional platforms for online trading in the Forex and other financial markets.

MetaTrader provided by Exness includes two main versions: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both versions offer a wide range of trading options, including:

- Charting and Analysis: The platform provides various types of charts and technical analysis tools such as indicators and analysis objects that help traders predict the direction of prices.

- Trading Operations: MetaTrader allows you to execute various types of trading orders, including market orders, pending orders and trading using Expert Advisors (EAs).

- Automated Trading: Traders can create and use trading robots (expert advisors) to automate trading based on predefined strategies.

- Trading position management: The platform provides the ability to open, close and modify trading positions, as well as manage stop losses and take profits.

- News Feeds and Analytics: MetaTrader also provides access to news feeds and analytical tools that help traders stay up to date with the latest developments in the financial markets.

Exness’s MetaTrader platform provides a reliable and convenient tool for conducting trading operations in the Forex and other markets, while possessing a wide range of functions and tools for analyzing and managing trading operations.

Exness Account Types

Exness offers several types of trading accounts to suit the different needs and preferences of traders. Here are some of the main account types that are available on the Exness platform:

- Standard Account: This type of account usually offers fixed or floating spreads, depending on the trader’s choice. The Standard account is generally recommended for beginner traders or those who prefer simple trading conditions.

- Raw Spread Account: This type of account offers traders very low spreads, but may incur trading fees in return. A low spread account is usually preferred by experienced traders who are looking for the best trading conditions and are willing to pay commissions for low spreads.

- Zero Account: This account type offers spread-free trading, but may in exchange be charged a flat trading fee. A no-spread account may be preferable for traders who frequently open and close positions and want to avoid the impact of spreads on their trading.

- ECN Account: This type of account provides access to trading in the interbank market using liquidity from various providers. An ECN account typically provides tight spreads and a deeper market, which can be attractive to traders with high trading volumes.

In addition, Exness may also offer special account types or promotions for new and existing customers. It is important to review the terms and conditions of each account type and choose the one that best suits your needs, strategy and level of trading experience.

Exness Bonuses

Exness offers various bonus programs and promotions for its clients. Here are some of the typical bonuses that may be provided on the Exness platform:

- Deposit Bonus: This is one of the most common types of bonuses where clients can receive additional funds into their trading account when they make a deposit. For example, Exness may offer a bonus in the form of a certain percentage of the deposit amount.

- Contests and Sweepstakes: Exness may from time to time conduct trading contests and sweepstakes among its clients where winners may receive additional prizes, such as additional trading account funds or other bonuses.

- Loyalty Program: This could be a program that provides incentives and bonuses based on customer activity on the Exness platform, such as trading volumes or number of trades. For example, clients can receive bonuses in the form of additional funds or preferential trading conditions depending on their activity level.

- Referral Bonuses: Exness may offer bonuses for bringing new customers to the platform through referral programs. For example, a client can receive a bonus for each invited friend who registers and starts trading on Exness.

Each specific promotion or bonus program may have its own terms and conditions, so it is important to review the detailed information on the official Exness website or contact support for more information.

Exness partners

Exness collaborates with various partners, including financial institutions, technology companies, liquidity providers and other financial market participants. Here are a few types of partners that Exness can work with:

- Payment systems: Exness works with various payment systems such as banks, e-wallets and payment cards to provide its customers with convenient and secure ways to deposit and withdraw funds.

- Liquidity Providers: These are financial institutions and banks that provide liquidity for trading in the Forex and other markets. Exness partners with various liquidity providers to provide its clients with the best trading conditions.

- Technology Partners: Exness also partners with various technology companies who provide various technology solutions and tools to enhance trading on their platform, such as trading platforms, analytical tools, etc.

- Affiliates and Marketing Partners: Exness may also partner with affiliates, bloggers, traders and other members to promote its services and attract new customers through affiliate programs and marketing initiatives.

These are just a few examples of the types of partners Exness can work with. Each partnership may have its own goals and terms of cooperation, depending on the needs and strategy of the company.

Exness Copy Trading

Exness provides a Copy Trading service that allows traders to automatically copy trades of experienced and successful traders into their own trading accounts. This allows less experienced traders to profit by following the strategies and actions of more experienced market participants.

The way Copy Trading generally works is that traders who share their trades for copying are called “signal providers,” and those who copy their trades are called “subscribers.” Subscribers can select signal providers based on their past success, trading strategy, risk management and other parameters.

Exness provides Copy Trading functionality through its platform, allowing clients to conveniently configure copy trade options, manage risk, and monitor strategy performance. This can be a useful tool for both new and experienced traders who want to expand their trading arsenal and diversify their investments.

Exness financial company – pros and cons

Exness is one of the largest and most well-known brokers in the online trading industry, and it has a number of advantages and disadvantages that are worth considering when deciding which company to choose. Here are some of them:

Pros of Exness

- Reliability and Reputation: Exness has been in the industry for many years and has a strong reputation as a reliable and honest broker. It is regulated by relevant authorities in various jurisdictions, which ensures security for customers.

- Wide Selection of Trading Instruments: Exness offers access to a wide range of markets, including Forex, Metals, Energy, Stocks and Cryptocurrencies, allowing clients to diversify their investments.

- Variety of Trading Accounts: Clients can choose from different types of trading accounts with different trading conditions, spreads and commissions, allowing them to choose the right account to suit their needs and preferences.

- Technological Innovation: Exness is constantly introducing new technologies and tools to improve the trading experience of its clients, such as trading through mobile applications, analytical tools, etc.

Cons of Exness

- Limited Training Resources: Apart from basic training materials, Exness may leave a lot to be desired in training resources and materials for its clients, especially those new to trading.

- Limited Regulatory Protection: Depending on the jurisdiction in which a client is registered, the level of regulatory protection may vary, which may raise concerns for some traders.

- Commissions and Spreads: Some clients may find Exness’ commissions and spreads to be relatively high compared to other brokers, especially on some account types.

These pros and cons should be considered when deciding whether Exness is the right broker for you for your trading.

Frequently asked questions

Can I trust Exness?

Yes, overall, Exness is a reliable and respected broker in the online trading industry. They have been in the market for many years and have a strong reputation as a reliable broker. The company is regulated by relevant authorities in various jurisdictions, which provides an additional level of security for customers.

However, as with any financial decision, it is important to be cautious and do your research before making a final decision. It is recommended that you read the terms of service, read reviews and recommendations from other traders, and contact the company’s support team with any questions or concerns you may have.

Is Exness Illegal?

No, Exness is not an illegal broker. They operate as a legal financial services company and are regulated by the relevant financial authorities in the various jurisdictions where they provide their services. Depending on the client’s location and the jurisdiction in which it trades, Exness may be licensed and regulated by various authorities such as CySEC (Cyprus), FCA (UK), FSCA (South Africa), etc.

However, it is important to note that even though Exness has all the necessary licenses and regulations, they may still be subject to criticism or complaints from individual customers. It is important to exercise caution and do your own research before making a final decision to trade with Exness or any other broker.

Which country does Exness belong to?

Exness is a brokerage company founded in 2008. The company’s main offices are located in different countries, including Cyprus and the UK. However, Exness does not belong to any specific country as it is an international company providing its services to clients from different countries around the world.

Exness Brokerage is licensed and regulated by the relevant financial authorities in the various jurisdictions where it provides its services. This allows Exness to operate in accordance with the law and provide a high level of security for its clients.

Exness’s main activity takes place in the online environment, which allows them to operate internationally and serve clients from around the world without being tied to a specific country of the owner.

Is Exness profitable?

Exness is a commercial organization and its profitability depends on many factors, including the trading volume of clients, the commissions and spreads they charge for their services, operating expenses, and others. Typically, successful brokerages like Exness strive for profitability by providing quality service to their clients and effectively managing their operating expenses.

However, without having access to Exness’s financial statements, I can’t say for sure how profitable the company is. However, given its long history in the market and good reputation, it can be assumed that it has a stable financial position.

It is important to remember that investing or trading in the financial markets always involves risk and results may vary for each investor. Therefore, make your investment decisions consciously and base them on your own research and analysis.

How rich is Exness?

As a company, Exness is not publicly visible, and financial data such as its wealth and profits may be confidential. Information about a company’s wealth and financial position may only be available within the company or in its reports to regulators.

Overall, Exness is one of the largest and most well-known brokers in the international market, and judging by its longevity in the market and reputation, it can be assumed that it has a stable financial position.

However, without access to specific financial data, it is impossible to give an accurate estimate of Exness’s wealth.

How old is Exness?

Exness was founded in 2008. Thus, by 2024 the company would be 16 years old. During this time, Exness has grown significantly and has become one of the leading brokers in the global online trading market.

Is Exness suitable for beginners?

Yes, Exness is suitable for beginners in trading the financial markets. Here are a few reasons why Exness may be a good choice for new traders:

- Educational Resources: Exness provides extensive educational materials, including video tutorials, articles, guides and other materials to help beginners understand the basics of trading the financial markets.

- Demo account: Exness has the opportunity to open a demo account where beginners can practice and master trading without the risk of losing real funds.

- Wide Selection of Trading Instruments and Accounts: Exness offers various types of trading accounts with different trading conditions, allowing beginners to choose the right account according to their needs and experience level.

- Technological Innovation: Exness offers state-of-the-art trading platforms and technology tools that make trading and market analysis easier, which can be especially useful for beginners.

- Customer support: The company provides 24/7 customer support in multiple languages, which will help newbies get answers to their questions and solve any problems they may have.

Overall, Exness provides all the necessary tools and resources so that beginners can begin their journey in the world of online trading with minimal problems and risks.

Is Exness a real broker?

Yes, Exness is a real broker in the financial markets. They provide access to trading in Forex, metals, energies, stocks and cryptocurrencies. Exness was founded in 2008 and has since gained wide recognition and reputation as one of the leading brokers in the industry.

Exness holds all necessary licenses and is regulated by the relevant financial authorities in the various jurisdictions where it provides its services. This provides clients with a high level of security and protection of their funds.

Exness clients can open trading accounts, conduct trading operations, access various tools and analytical resources, and receive customer support from the company.

Why Exness is the best solution?

Assessing whether Exness is the best broker depends on each trader’s individual needs and preferences. However, there are several reasons why many traders choose Exness:

- Reliability and Reputation: Exness has a strong reputation as a reliable and honest broker, having been in the industry for many years. They are regulated by the relevant financial authorities in various jurisdictions, which ensures security for customers.

- Wide range of trading instruments: Exness offers access to a variety of markets, including Forex, metals, energies, stocks and cryptocurrencies, allowing clients to diversify their investments.

- Variety of account types: Clients can choose from a variety of trading account types with different trading conditions, spreads and commissions, allowing them to choose the right account to suit their needs and preferences.

- Technological Innovation: Exness offers state-of-the-art trading platforms and technology tools to make trading and market analysis easier for clients.

- Customer Support: The company provides 24/7 customer support in multiple languages to help customers get answers to their questions and resolve any issues they may have.

Despite these advantages, the decision as to whether Exness is the best broker depends on each trader’s individual preferences, trading strategy, and needs.

Which bank does Exness use?

Exness cooperates with various banks to facilitate transactions with client funds. Typically, brokers maintain relationships with several banks for various types of transactions, such as storing client funds, processing payments, and others.

Because of this, Exness may partner with different banks depending on the customer’s location, account currency, and other factors. The names of specific banks may be available for internal use only and are not necessarily disclosed publicly.

However, it is important to note that Exness provides secure custody of client funds and complies with all necessary rules and regulations set by regulatory authorities to ensure safe and secure fund transactions.

A final word about financial company Exness

Exness is a reputable and reliable broker offering a wide range of trading instruments and different types of trading accounts. Their technological innovation and reputation as a reliable broker make them an attractive choice for many traders. However, they may have limited training resources and regulatory protections, and commissions and spreads may be higher than other brokers. Overall, Exness is a good choice for those looking for a reliable and innovative broker, but requires careful consideration of terms and conditions and comparisons with other options.